Mobile Payment Solutions in Cambodia: A Cashless Future

Discover how mobile payment solutions in Cambodia are shaping a cashless future with secure, efficient, and innovative financial technology.

Mobile payment solutions in Cambodia have been somewhat well-known recently, transforming the way transactions are done. Businesses and customers are quickly moving to digital payments in Cambodia as cellphones and internet connectivity become more easily availables.

This transition is driven by the need for convenience, security and efficiency, enabling seamless financial transactions across different sector.

The Growth of Mobile Payment Solutions in Cambodia

Mobile payment solutions in Cambodia have been adopted with exponential increase. Government programs, technology developments, and growing inclination for cashless transactions are few among the several elements influencing this change.

The widespread availability of mobile wallets in Cambodia has also played a significant role in accelerating this change.

Government and Regulatory Support

By means of favorable policies and laws, the Cambodian government has actively pushed the acceptance of digital payments in Cambodia. Initiatives include the Bakong system, a blockchain-based digital payment network enabling real-time transaction. IT have been presented by the National Bank of Cambodia (NBC). These step guarantee economic development and financial inclusion.

Read more: Digital Wallets and the Future of Payments in Cambodia

Technological Advancements in Fintech

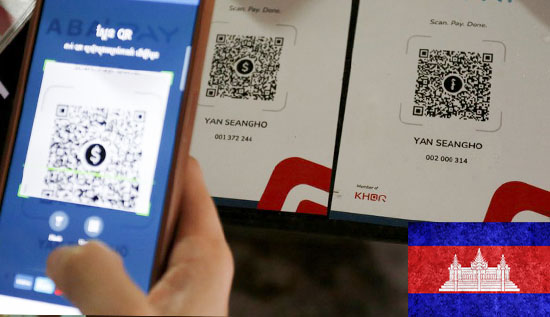

Fintech innovations in Cambodia have significantly transformed the financial landscape. With the introduction of qr code payments in Cambodia, Consumers can quickly buy now by scanning QR codes at different stores. By simplifying payment system, this technology has lessened dependency on actual cash and improved financial accessibility for both urban and rural area.

The Role of Mobile Banking in Cambodia

As mobile banking adoption in Cambodia rises, bank and other financial institution are providing creative offerings meant to improve consumer experience. By including electronic payment systems into mobile banking applications, customers may easily send money, pay bills and shop online.

Benefits of Mobile Banking

- Users may access their accounts and make transactions anywhere, at any time, therefore attaining convenience.

- Improved security measures including authentication and encryption guards consumers from illegal behavior.

- Efficiency lowers transaction processing times and helps to shorten lines at banks.

The Rise of Cashless Transactions in Cambodia

For many reasons, inclination for cashless transactions in Cambodia keeps rising. Digital payments provide a flawless experience for customers and companies alike and help to lower the hazard involved in carrying actual money.

How Cashless Transactions Are Transforming Businesses

To improve consumer happiness and efficiency, several company have included online payment platforms into their daily activities. From local markets to e-commerce establishment, contactless payments have evolved into a preferred way of transaction guarantee a quick and safe purchase experience.

The Future of QR Code Payments and Mobile Wallets

As qr code payments in Cambodia gain momentum, they are expected to become a standard payment method across various industries. Leading fintech companies are collaborating with merchants to expand digital wallets adoption, allowing users to pay for goods and service instantly.

Challenges and Opportunities

Despite the rapid growth, certain challenges persist in the adoption of mobile wallets in Cambodia. Problems include cybersecurity risks, low digital literacy, and limited smartphone usage in rural areas demand attention. Still, with ongoing technological developments and growing financial consciousness, the future of mobile payment solutions in Cambodia remains promising.

Impact on Consumer Behavior

Consumers in Cambodia are becoming more tech-savvy, embracing the convenience of digital payments. The shift from cash to electronic payment systems is evident in urban center where business have adopted contactless payments as a standard practice. Rural areas are also gradually being impacted by this shift as mobile banking solutions are being brought to close the financial disparity.

Adoption Among Small Businesses

Small businesses are key players in the Cambodian economy, and their adoption of mobile payment solutions in Cambodia has significantly increased. Vendors, street food stalls and market sellers now accept qr code payments in Cambodia, simplifying exchanges for sellers as well as buyers. Along with increasing sales effectiveness. This change lowers cash handling risk.

The Road to Financial Inclusion

One of the biggest benefits of digital payments in Cambodia is financial inclusion. The traditional banking system has left many individuals unbanked, particularly in rural areas. However, the rise of mobile wallets in Cambodia and peer-to-peer payment apps is providing access to financial services for those who previously had no access to bank.

Reducing Dependence on Physical Cash

As Cambodia moves toward cashless transactions in Cambodia, reliance on actual money is lessened. Minizing problem with counterfeit money and cash shortages helps the economy from this change. Growing availability of electronic payment system has made financial transaction more transparent and safer.

Conclusion

The adoption of mobile payment solutions in Cambodia is reshaping the financial ecosystem, offering greater convenience and efficiency. As digital payments in Cambodia continue to evolve, businesses and consumers are benefiting from a secure, cashless environmen

With government support, fintech innovations in Cambodia and the increasing reliance on cashless transactions in Cambodia, the country is well on its way to achieving a digital financial revolution.

Frequently Asked Questions

1. What are mobile payment solutions in Cambodia?

Mobile payment solutions refer to online payment platforms that allow users to make transactions using smartphones, such as mobile wallets in Cambodia and qr code payments in Cambodia.

2. How safe in Cambodia are digital payments?

In order to guarantee safe transactions for consumers, digital payment systems apply fraud detection also authentication and encryption.

3. How might fintech advances benefit Cambodia?

With their sophisticated solutions—contactless payment and peer-to-peer transfers—fintech innovations in Cambodia propel digital revolution in banking and payment.

4. Are QR code payments accepted most everywhere in Cambodia?

Indeed, numerous retailers, restaurants and businesses now take qr code payments in Cambodia, therefore expediting and simplifying transaction.

5. How might customers gain from the acceptance of mobile banking in Cambodia?

Mobile banking adoption in Cambodia gives access to bill payments, internet transfers and financial services, therefore lowering the demand for actual branch visits.

6. What difficulties might mobile wallets in Cambodia run across?

Among the challenges are cybersecurity concerns, poor digital literacy, and restricted access to cellphones in remote communities.

7. What is the future of cashless transactions in Cambodia?

With increasing fintech investments and government support, cashless transaction in Cambodia are expected to become the norm and enhancing financial inclusion and economic growth.

More Articles

06 Dec 2025

06 Dec 2025

AI Chatbots for Customer Support & Virtual Assistants

Boost customer satisfaction with intelligent AI chatbots for customer support. Deliver instant responses, automate service tasks, and scale your support team 24/7 with smart virtual assistants.

06 Dec 2025

06 Dec 2025

Custom Apps vs Ready-Made Software: Key Benefits

See how custom apps vs ready-made software impact productivity, integration and flexibility for businesses of all sizes.

05 Dec 2025

05 Dec 2025

eWallet and Online Transaction Security in Cambodia

Stay protected with essential insights on eWallet and online transaction security in Cambodia, covering key risks, safety practices, and fraud prevention tips.

04 Dec 2025

04 Dec 2025

Apply for Senior Business Analyst – Loma Technology

Detailed resource explaining the Senior Business Analyst Loma Technology role, ideal for candidates seeking clarity on expectations and recruitment stages.